Investing in corporate debt securities has become an increasingly attractive option for investors seeking steady returns in the current economic climate. In the American market, these financial instruments offer a range of opportunities for those willing to diversify their investment portfolios beyond traditional equities.

Understanding the landscape of corporate bonds and how to assess their risk is crucial for making informed decisions. This blog post explores the potential benefits and strategies associated with buying company-issued bonds while providing insights into risk evaluation.

Opportunities in the American market

The American corporate bond market presents investors with diverse opportunities owing to its size and maturity. U.S. corporations typically seek to raise capital for growth or managing liabilities by issuing bonds, presenting a wide spectrum of choices for potential buyers. This market spans different sectors, offering various risk profiles—from high-yield, lower-rated bonds to stable investment-grade options.

The appeal of these securities often lies in their potential to generate predictable income, particularly in a low-interest environment where traditional savings avenues offer minimal returns. Seasonal fluctuations and economic cycles also play a significant role, providing opportunities to acquire bonds at favorable prices or yield levels, thus enhancing overall portfolio performance.

High-yield vs. investment-grade

Corporate debt investments can typically be classified into two categories: high-yield and investment-grade bonds. High-yield bonds, often referred to as junk bonds, are issued by companies with lower credit ratings. These bonds offer higher interest rates to compensate for the increased risk associated with the issuer’s potential default.

While they may seem enticing due to their substantial yield, investors must conduct careful analysis to gauge the issuer’s financial health and the broader economic environment. Not all high-yield bonds present the same level of risk, and discerning investors should differentiate between transient financial setbacks and systematic instability within a company.

Understanding maturity and yield

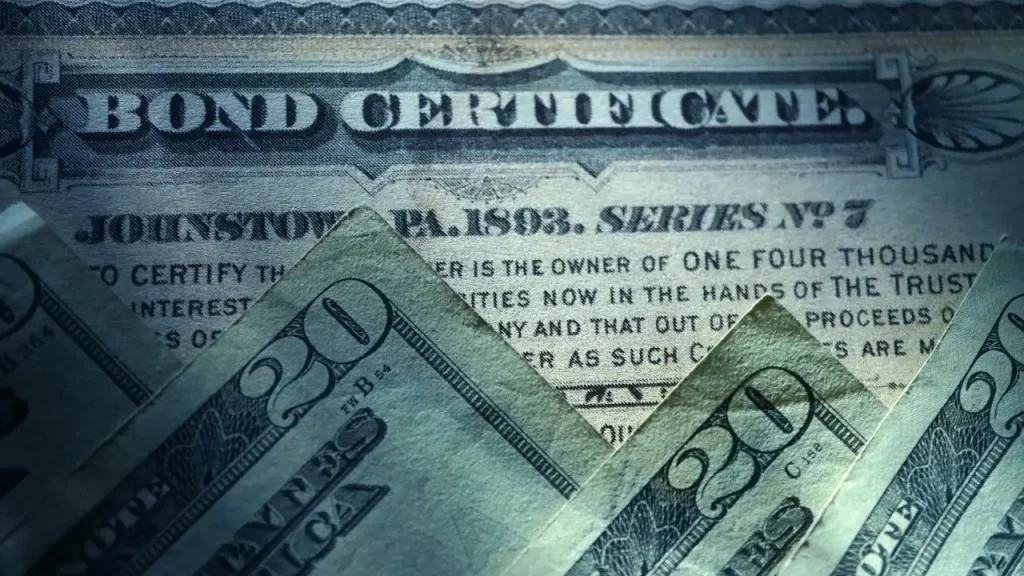

Maturity and yield are critical concepts that every investor must grasp when delving into corporate debt securities. The maturity of a bond refers to the time frame in which the issuer repays the principal amount. Bonds can have short, medium, or long-term maturities, each affecting the security’s interest rate and risk profile.

Short-term bonds are generally perceived to be less risky, given their quick approach to maturity, and are favored in unpredictable economic conditions. In contrast, long-term bonds often offer higher yields due to the increased risk of interest rate fluctuations over extended periods.

How to assess risk

Evaluating the risk associated with corporate bonds is a multifaceted process that involves analyzing the issuer’s financial health, industry conditions, and macroeconomic factors. A thorough review of the issuer’s financial statements, including balance sheets and income statements, provides insights into the company’s ability to meet its debt obligations.

Key financial ratios, such as the debt-to-equity ratio and interest coverage ratio, further illuminate the company’s leverage and capacity to sustain interest payments, highlighting potential risks to bondholders. In addition to financial metrics, investors should assess industry trends that could influence the issuer’s performance.

Mitigating risks through diversification

Diversification is a powerful strategy for managing risks inherent to corporate bond investments. By spreading capital across various issuers, industries, and credit ratings, investors can reduce their exposure to specific risks that may affect individual securities.

A well-diversified portfolio mitigates the impact of adverse events on any single investment, balancing out losses and enhancing overall stability. To achieve effective diversification, investors should undertake a disciplined approach, with clear objectives aligned to their risk tolerance and investment timeline.

Incorporating bonds from different sectors provides protection against industry-specific downturns, while mixing both domestic and international issuers can guard against regional economic fluctuations. Investors should also consider varying the maturities of their bonds, creating a laddered structure that aligns with their cash flow needs and market outlook.

Leveraging tools and resources

Access to reliable tools and resources is indispensable for investors assessing the risk of corporate debt securities in the American market. Financial news platforms offer real-time data and insights, helping investors track market trends and economic developments that may influence bond performance.

Subscription-based services such as Bloomberg or Reuters provide comprehensive analysis, including bond ratings, yield comparisons, and credit risk assessments, enhancing the investor’s ability to make informed decisions.

Additionally, investors can leverage analytical tools like the yield curve and bond calculators, which help evaluate potential returns and visualize interest rate impacts across various maturities. Utilizing risk management software and services, investors can simulate scenarios and stress test their portfolios to assess resilience against potential market disruptions.