Gaining control of your household finances is crucial for achieving financial well-being. Creating a family budget is an effective way to manage expenses and enhance savings. By mastering budget management, you can develop better financial habits and meet your savings goals.

This guide focuses on “Family Budget” as a blueprint for controlling spending and improving savings. Whether you’re new to budgeting or looking to refine your approach, this post will offer valuable strategies for managing your funds wisely.

Understanding the importance of a family budget

A family budget serves as a financial roadmap, guiding the allocation of income for various needs and desires. It creates control and encourages responsible spending, ultimately leading to increased savings.

In a consumer-driven culture like the U.S., budgeting helps prioritize necessities while reserving funds for savings and emergencies, which is crucial for financial stability. A budget enables tracking of finances, identification of unnecessary expenses, and redirection of funds toward meaningful goals like homeownership or education.

It also curbs impulsive purchases that can lead to debt and fosters informed financial decision-making. Moreover, a family budget improves relationships by promoting open communication and shared responsibility for financial goals.

Involving everyone encourages teamwork and reduces tension. Teaching children about budgeting nurtures financial literacy, preparing them for responsible behavior as adults. Overall, a family budget fosters harmony and equips the family for a brighter, stress-free future.

Steps to creating an effective family budget

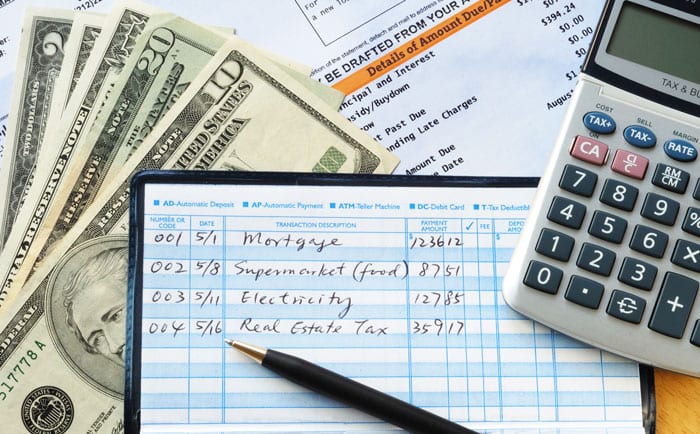

Creating a family budget involves a systematic approach. Start by gathering financial documents like pay stubs, bank statements, and monthly bills to understand your income and expenses. Analyze cash flow and categorize expenses into fixed (e.g., rent) and variable costs (e.g., groceries) to identify areas for cost-cutting.

Set realistic financial goals that align with your family’s needs, such as paying off debt or saving for education. Assign specific amounts to each category, prioritizing essentials while allowing for leisure activities.

Regularly monitor and adjust the budget to reflect changes in income or spending habits, involving the whole family to encourage accountability. An adaptable budget is essential for achieving financial goals and maintaining financial health.

Common pitfalls and how to avoid them

When managing a family budget, common pitfalls can derail plans. One mistake is underestimating expenses or overlooking irregular costs, like annual insurance premiums. To avoid this, create a contingency fund and review past spending patterns.

Another issue is failing to track spending accurately. Use budgeting apps or spreadsheets to keep detailed records, helping identify trends and necessary adjustments. Overspending on non-essentials, such as dining out, can erode savings; set spending limits and seek cost-effective alternatives.

Additionally, avoid lifestyle inflation, where increased income leads to higher spending instead of saving. Finally, ensure all family members communicate about finances through regular budget meetings. This fosters unity and commitment to shared goals, promoting overall financial health.

Tips for saving more effectively

Saving effectively within a family budget requires strategic planning and discipline. Start by automating savings to direct a portion of income into a savings account, reducing the temptation to spend. Create separate accounts for specific goals, like emergency funds or vacations, to keep resources organized.

Adopt frugal habits to cut expenses without sacrificing quality of life, such as using coupons, conserving energy, or choosing generic brands. Small changes can lead to significant savings over time.

Educate family members about financial literacy to foster awareness and shared responsibility. Involving children in saving experiences teaches valuable lessons in patience and prioritization. With everyone informed, saving becomes a collective effort, enhancing financial security for the family.

The role of financial education

Financial education is crucial for managing a family budget effectively. Understanding key concepts like budgeting strategies, investment basics, and interest rates allows family members to make informed decisions. Online programs and community workshops can help fill knowledge gaps and provide practical money management advice.

When everyone understands financial principles, reliance on one person decreases, fostering diverse perspectives in financial planning. This education also helps prevent mistakes like misinterpreting credit terms.

Promoting financial literacy builds a supportive network that enhances the family budget over time. Ongoing learning enables families to adapt to economic changes and work toward shared goals, ensuring a brighter and more stable future for all.

Simplifying budget tools and resources for families

In today’s digital age, various tools can simplify family budgeting. Mobile apps like Mint and YNAB (You Need a Budget) track expenses, categorize spending, and visualize financial goals with features like shared access and real-time updates. They provide insights into spending habits and send alerts to help maintain budgets.

Traditional methods, such as envelope budgeting and spreadsheets, are also effective. Envelope budgeting limits spending by allocating cash for specific categories, while spreadsheets allow for manual tracking and easy sharing.

Choosing the right budgeting tool depends on your family’s needs and comfort with technology. Consistency in tracking expenses and updating the budget is key to reducing stress and improving efficiency in achieving financial goals.